How Do Legal Online Licensed Money Lenders in Singapore Work?

No matter how the economy is performing, we may occasionally find ourselves in an unfavourable financial situation. To tide us through a rough patch, some of us may decide to borrow money from a bank.

However, if you have urgent cash needs or a bad credit history, you may stand a better chance of getting your loan approved quickly at authorised instant money lenders’ instead. This comprehensive guide contains everything you need to know about licensed private money lenders in Singapore.

Table of content

Table of Contents

What exactly are licensed private money lenders in Singapore?

A licensed money lender is a business authorised by Singapore’s Ministry of Law to lend money to Singapore Citizens, Permanent Residents, as well as Foreigners with valid Work Passes. Authorised money lenders in Singapore must follow all rules and regulations set out by the Ministry of Law, and adhere to the Moneylenders Act.

Legalised money lenders in Singapore are also subject to additional layers of regulation from the Moneylenders Credit Bureau (MLCB). The Ministry of Law has designated Credit Bureau Singapore to operate MLCB, which contains information on borrowers’ loan and repayment records with all licensed money lenders in Singapore.

When you apply for a loan from a trusted money lender in Singapore, the money lender will have to check your existing loan records with other local money lenders. This is done through purchasing an MLCB report and this process of checking your existing loan records is required by the law. This way, legitimate money lenders can ensure that the approved loan amount does not exceed the borrower’s overall loan limit.

If you’re interested in acquiring an MLCB report, you can read more here.

One significant difference between banks and reliable licensed money lenders in Singapore is the speed of loan approval and cash disbursal. Compared to banks, established instant money lenders typically provide much faster services, which can be very useful if you need urgent access to cash. The ultra fast loan journey is a key reason why some prefer borrowing from licensed money lenders.

Additionally, legal money lenders in Singapore tend to have more relaxed loan restrictions and requirements, which makes them more accessible to people who may have difficulty obtaining loans from banks.

Advantages and disadvantages of borrowing from legal online money lenders in Singapore

While quick and reliable money lenders in Singapore offer many benefits, including those mentioned above, there are also some downsides to borrowing from licensed money lenders. Be sure to weigh the pros and cons carefully before making your decision.

PROS of borrowing from a legalised online money lender in Singapore

Fast approval

Most fast money lenders can approve your loan application in under 30 minutes,

especially if you have all the necessary supporting documents prepared.

Most fast money lenders can approve your loan application in under 30 minutes, especially if you have all the necessary supporting documents prepared.

Lower minimum income requirement

If you have an annual income of less than S$20,000, you would be hard-pressed to get your

loan applications accepted by banks. However, licensed private money lenders in Singapore

can offer you a loan even if your annual income is below S$20,000.

If you have an annual income of less than S$20,000, you would be hard-pressed to get your loan applications accepted by banks. However, licensed private money lenders in Singapore can offer you a loan even if your annual income is below S$20,000.

Streamlined application process

This means minimal red tape as the most reliable money lenders in Singapore typically favour

efficiency and are extremely customer-oriented. You’ll enjoy quicker responses from loan officers and

more personalised service altogether.

This means minimal red tape as the best money lenders in Singapore typically favour efficiency and are extremely customer-oriented. You’ll enjoy quicker responses from loan officers and more personalised service altogether.

Bad credit history will not be a deal breaker

Getting turned away from banks because you defaulted on your loans in the past? Trusted

money lenders in Singapore will give you a second chance after a detailed consultation.

You may even find some money lenders with no credit checks. What’s more, there are

even loans for bad credit.

Getting turned away from banks because you defaulted on your loans in the past? Trusted money lenders in Singapore will give you a second chance after a detailed consultation. You may even find some money lenders with no credit checks. What’s more, there are even loans for bad credit.

CONS of borrowing from licensed online money lenders in Singapore:

Higher interest rates

As legalised money lenders in Singapore generally take on a higher risk from their

borrowers as well as provide cash flow on short notice, their loans have relatively

higher interest rates compared to banks.

As legalised money lenders in Singapore generally take on a higher risk from their borrowers as well as provide cash flow on short notice, their loans have relatively higher interest rates compared to banks.

Costly late interest and fees

Late fees can go up to S$60 per month, while late interest can reach up to 4% per month.

However, rest assured that both charges are only levied on the overdue loan amount.

These fees do not apply to instalments that have not been charged yet. You can avoid

these by simply repaying your loan instalments on time.

Late fees can go up to S$60 per month, while late interest can reach up to 4% per month. However, rest assured that both charges are only levied on the overdue loan amount. These fees do not apply to instalments that have not been charged yet. You can avoid these by simply repaying your loan instalments on time.

Costly processing fees

Registered private money lenders in Singapore can charge a processing fee

of up to 10% of your loan principal amount. However, you only have to pay

this fee after your loan is approved.

Registered private money lenders in Singapore can charge a processing fee of up to 10% of your loan principal amount. However, you only have to pay this fee after your loan is approved.

Generally shorter loan tenures

Depending on the loan that you take up, the tenure can be shorter as compared

to its equivalent from a bank. This results in you having less time to repay the

loan from your local money lender, which also means that you need to be stricter

with your budget. The shorter the repayment period, the higher the amount paid

per instalment. Therefore, you will need to assess if the instalment amount is

reasonable for you based on your budget.

On the bright side, the total amount of interest paid can be less than a

bank loan with longer tenure.

Depending on the loan that you take up, the tenure can be shorter as compared to its equivalent from a bank. This results in you having less time to repay the loan from your local money lender, which also means that you need to be stricter with your budget. The shorter the repayment period, the higher the amount paid per instalment. Therefore, you will need to assess if the instalment amount is reasonable for you based on your budget.

On the bright side, the total amount of interest paid can be less than a bank loan with longer tenure.

Secured vs unsecured loans: Which is better from registered online money lenders in Singapore?

While fast licensed money lenders online usually provide a wide variety of loans, you need to first understand the difference between secured and unsecured loans.

Secured loans are backed by the borrower with assets such as a house or a vehicle. These assets are also known as ‘collateral’. Secured loans typically feature lower interest rates, a higher loan principal amount, and a longer tenure. Examples of secured loans include home and vehicle loans. However, should you default on your loan, you may lose your collateral.

Unsecured loans, on the other hand, do not require any collateral and typically feature higher interest rates, a lower principal amount, and a shorter tenure. Examples of unsecured loans include personal loans and payday loans from money lenders.

In that case, how do you know which type of loan to take up?

If you just need cash quickly to settle your wedding expenses, household emergencies, or even a medical bill, you’ll be looking at an unsecured personal loan. Personal loans are flexible loans that can cover anything from weddings to education fees.

Here are the different types of personal loans:

However, if you’re a business owner looking at injecting cash flow into growing or sustaining your SME, you may need a business loan. This loan type comes with a much higher principal amount and would require more supporting documents as well. Furthermore, you might need to take up a separate secured loan as well, if you wish to acquire a company vehicle.

How much can you borrow from a legal money lender in Singapore?

Secured Loans

For secured loans, there are three factors to consider:

Total Debt Servicing Ratio (TDSR)

The first metric is the borrower’s TDSR, which applies to property and car loans. TDSR is a fraction of the gross monthly income from a borrower that is utilised to service all their loans, and its maximum is 55%.

Mortgage Servicing Ratio (MSR)

The second metric is the borrower’s MSR, which is applicable for HDB and Executive Condominium (EC) loans. MSR is a fraction of the gross monthly income from a borrower that is taken to repay their property loans for HDB flats and ECs, and its maximum is 30%.

Loan-to-Value (LTV) Limit

Lastly, we have the LTV limit, which is applicable to car loans. LTV is the amount of loan expressed as a portion of the purchase price of the motor vehicle. That amount cannot exceed 60-70%, depending on the open market value (OMV) of your vehicle.

Unsecured Loans

For borrowers with an annual income of less than S$10,000, the maximum amount that can be borrowed by Singaporeans and Permanent Residents is S$3,000. For Foreigners residing in Singapore, this limit is S$500.

For borrowers with an annual income of at least S$10,000 but not more than S$20,000, the maximum amount that can be borrowed by Singaporeans, Permanent Residents, and Foreigners residing in Singapore is S$3,000.

For borrowers with an annual income of S$20,000 or more, the maximum amount that can be borrowed by Singaporeans, Permanent Residents, and Foreigners is six times their monthly income.

Familiarise yourself with licensed money lenders’ interest rates

Because all legal money lenders in Singapore are required to follow the laws and guidelines prescribed by the Ministry of Law, they adhere to strict limits on interest rates.

Law-abiding licensed money lenders cannot charge more than 4% in interest per month. Fortunately, licensed money lenders’ interest rates are calculated based on a reducing interest rate. This results in you paying less interest over time as compared to a flat interest rate.

| Month | Payment Amt (S$) | Interest (S$) | Principal (S$) | Balance (S$) |

|---|---|---|---|---|

| 1 | 572.29 | 120 | 452.29 | 2547.71 |

| 2 | 572.29 | 101.91 | 470.38 | 2077.33 |

| 3 | 572.29 | 83.09 | 489.20 | 1588.13 |

| 4 | 572.29 | 63.53 | 508.76 | 1079.37 |

| 5 | 572.29 | 43.17 | 529.12 | 550.25 |

| 6 | 572.29 | 22.01 | 550.25 | 0 |

The table visualises this:

Say you borrowed S$3,000 to be repaid over six months with an interest rate of 4% per month.

The total reduced balance interest you will be paying is S$433.71, and not S$720 (if it is a flat interest rate calculation). The interest you pay every month decreases with each instalment paid.

If you make a late repayment to a licensed money lender, no more than 4% late interest per month and a late payment fee of no more than S$60 per month can be charged on the amount that is repaid late.

Also, do take note that all charges – from the interest to late fees and processing fees – cannot exceed the loan principal amount.

The loan tenure you receive would vary from lender to lender and loan to loan, but the most reliable money lenders in Singapore generally offer up to 12 months, while some may offer only one to six months. A small number of money lenders may extend the loan tenure up to 24 months. On average, the loan amount approved can range from one to three times the borrower’s monthly income, with a processing fee of around 3.5% to 10% of the loan amount.

Verify if your money lender is legal: How to check a money lender’s licence?

Now that you’re familiar with the interest rates and fees from licensed money lenders online, let’s look at how to find the right local money lender for your financial needs.

First and foremost, it is imperative to confirm that the fast money lender you’re dealing with is a legal and licensed business. In addition to protecting yourself from getting scammed or receiving unfair deals, this is also to ensure that you will not be embroiled in illegal financial activities.

To do this, follow this checklist of requirements:

Is the money lender in the

Ministry of Law’s Registry?

Firstly, refer to the complete list of authorised money lenders registered with the Ministry of Law. Rest assured that this list is updated frequently. In the list are addresses, phone numbers, names of companies, websites, and licence numbers that you can use to cross-check and confirm the legitimacy of the lender.

How is the money lender

advertising its loans?

According to the Ministry of Law, licensed money lenders in Singapore are not allowed to solicit loans through phone calls, text messages, or social media platforms.

Additionally, do take note that all legalised money lenders in Singapore can only advertise or solicit business through business or consumer directories, their websites, and advertisements located on the interior and exterior side of their registered place of business. These include the office’s gates, walls, and windows.

Lastly, avoid loan shark advertisements. You should not approach these unlicensed quick money lenders, even if you’re in urgent need of cash. The repercussions are not worth it at all.

Do online money lenders in Singapore exist? Do they need you to go down to their office?

Although you can easily apply for your loan via a licensed money lender’s website, even the most efficient online money lenders cannot fully process an application without an in-person appointment. They are required to meet the borrower at their approved place of business (i.e. their office) to conduct a physical face-to-face verification of the borrower’s identity.

Is their money lender licence displayed clearly in their office?

When visiting the money lender’s registered place of business, do look out for their money lender licence. All legitimate money lenders are supposed to display their licence prominently, allowing borrowers to verify their legitimacy.

Which money lender is suitable for you? Check reviews on licensed money lenders in Singapore

Unsure of which licensed money lender to borrow from? Here’s a checklist on how you can find out if they are the most suitable ones for you:

Check the background and reviews of the registered money lender

Search the registered money lender on Google and check their reviews. Do favour those that seem more genuine. Also, look out for any red flags on the money lender’s website that might suggest illegal activities or reviews that include complaints against the money lender.

Assess if the interest rate and loan terms are suitable for you

It’s important to check with the money lender the interest rates and loan tenures they can offer you, to see if they are compatible with your unique financial situation.

If you have a smaller budget, you might want to consider borrowing from licensed money lenders who can offer you a longer loan tenure. This way, you can pay less per instalment. The downside of a longer repayment period is that the total interest you need to pay will be higher.

On the other hand, if you have the budget every month for a larger loan instalment, you might prefer a shorter tenure. As mentioned, you will have to pay off more of the loan every month, thus clearing your loan at a quicker pace and accruing less interest.

Also, do check the other terms and conditions of the loan contract (including late fees, late interest, and processing fees) and see if you disagree or need clarification on any of these T&Cs. Remember, you are allowed to leave at any time and consult another money lender for better terms before signing the contract.

Communication

When interacting with the loan executive, do you feel that a solid bridge of mutual respect and communication is formed? The nature of this relationship is important as it can determine how much stress you feel and how much support you will receive from this money lender if you’re faced with difficulties during the repayment process.

What documents are required when you apply for a loan?

For fast money lenders to process your personal loan application as quickly as possible, you will need the following documents:

Employed Singaporeans:

NRIC

Latest three months of CPF contribution statement

Latest year’s IRAS Notice of Assessment (NOA)

Self-employed Singaporeans

NRIC

Latest two years of IRAS Notice of Assessment (NOA) or

Any proof of income such as an invoice or bank statement

Foreigners residing in Singapore

Work pass

Passport

Proof of home address such as a tenancy contract or billing proof

Latest three months of payslips

For the licensed money lender to process your business loan application, you will need the following documents:

- ACRA business profile information

- Constitution of the company

- Latest two years of Notice of Assessment (NOA) of all directors and/or shareholders of the company *

- Latest Credit Bureau Singapore (CBS) report of all directors and/or shareholders of the company *

- Latest two years of the company’s financial statements

- Latest six months of the company’s bank statements

- NRICs of the company’s major shareholders and directors

- Other documents that the licensed money lender might need.

* Documents are accessible via Myinfo login with Singpass.

Before you apply for any loan from quick money lenders, remember to check and compare money lenders to see which one offers the most competitive rates and loan terms for you.

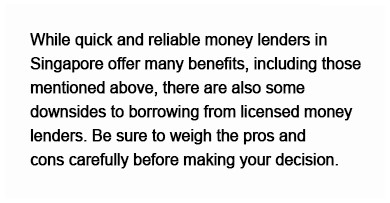

A step-by-step guide to applying for your loan from an online money lender in Singapore

Complete the

online application form

Dio Credit is a trusted money lender in Singapore that offers a streamlined application process as well as professional, friendly service.

What can I do if my loan application gets rejected?

If your loan is rejected by legal money lenders in Singapore, you might not have met certain criteria. Here are some things that you can do to increase the chances of getting your loan approved the next time you apply:

If your loan is rejected by legal money lenders in Singapore, you might not have met certain criteria. Here are some things that you can do to increase the chances of getting your loan approved the next time you apply:

Find a guarantor

One key reason why a loan application is rejected is that the lender does not believe you can repay the loan. This itself may be due to several reasons, from a monthly income that is too low to a loan amount request that is too high or beyond what the lender thinks you can repay.

Finding someone who has a good credit history to be your guarantor may give the lender enough confidence to approve your loan. A guarantor is someone who has the responsibility to repay the borrower’s loan obligations should they default. Therefore, a guarantor should be someone who can repay the debt and is trusted by the borrower.

Apply for a secured loan

A secured loan, where you pledge an asset as collateral, gives the money lender more confidence to approve the loan. This is because if you were to default, the money lender can liquidate your collateral to recover the loan amount, effectively repaying the loan.

Get more consistent sources of income

If you do not have a consistent source of income, it signals to the money lender that you may not have the capacity to repay the loan.

However, you don’t have to be employed full-time to get your loan approved. As long as you have consistent sources of income, be it from driving for Grab, collecting rent from a property you own, or profits through your business, you may stand a higher chance of getting your loan approved.

Don’t juggle too many loans at one go

It may get difficult to repay loans if you’re repaying multiple loans from money lenders at one go. Thus, your current loan record and borrowing history are something the money lender will consider. If you have a few active loans, finish paying off some of them before applying for a new one.

What do I do when the money lender claims I did not repay my loan?

Check your payment records

Firstly, check if you received receipts for the payments that you’ve made. You should be receiving receipts every time you repay an instalment, and you should check that the transaction details are correct. The receipt, which can be a digital or physical one, should also show the outstanding amount you owe so that you can plan your finances accordingly.

If you made your repayment via cash, you should receive a receipt as well. Do exercise your rights and demand for one if the licensed money lender’s staff does not want to provide you with one.

Secondly, did you receive any Statements of Accounts (SOA)? These statements contain details of payments received by the licensed money lender and the dates on which they were made, as well as the loan’s outstanding amount. The lender is obliged to provide you with the SOA, so do ask for it, especially if there are discrepancies when it comes to repayment records.

Check your bank account’s records

If you paid via bank transfer, check your bank account and retrieve that proof of transaction. Was it paid to the licensed money lender’s registered company? If so, that should be sufficient proof of payment as the record will contain all the necessary details for the money lender to perform another check on their end.

Discuss with the money lender

Contact the licensed money lender you borrowed from and ask for a meeting with a loan officer. Show them the payment records as mentioned above, and discuss the situation with them calmly to see if there was any miscommunication along the way. It can be as simple as a message being sent to the wrong email or phone number.

If the previous receipt you provided was not sufficiently clear, request a clearer receipt that states the outstanding amount the next time around.

What if you’re unable to pay money lenders in Singapore?

Firstly, you can request an extension of your instalment’s deadline. Explain sincerely and truthfully your situation to your money lender, and negotiate with them to come up with an extended payment deadline. Do ensure that this new deadline is derived through proper financial planning and that it can be met.

Next, if you are unable to repay your debts and are under a lot of stress to accrue the funds required, you can also seek help from social service agencies as recommended by the Ministry of Law. These agencies can provide general credit management help and credit counselling, and they may also be able to help you negotiate a debt repayment plan with your creditors.

Lastly, if your debt has exceeded S$15,000 and you are repeatedly defaulting despite payment extensions, you can file for bankruptcy. While this is an absolute last resort that no one wants to use, bankruptcy stops the accumulation of loan interest and prevents legal proceedings from being carried out against you.

That said, the consequences of bankruptcy can be severe and long-term.

At Dio Credit, our professional and friendly loan officers are always available to help you renegotiate your loan terms with us if you are struggling to repay your loan.

Five points to note before borrowing from authorised money lenders in Singapore

Here are five important points to note, letting you make the greatest use of authorised money lenders in Singapore and their services:

Abide by the loan contract’s terms

It’s never good to violate any of the loan contract’s terms, as you run the risk of incurring a penalty.

For instance, if you do not pay your loan instalments by a specified date, you may incur late interest charges and/or late payment fees. This increases the overall amount you have to pay.

You may also wonder, can a money lender file a case in court? Yes, the licensed money lender can file for litigation against you in court if you default on the loan. Additionally, if your money lender manages to make a successful claim against you, you will have to bear the legal costs as decided by the court.

Hence, it is important to fully understand how the contract works as well as all the loan terms dictated in the contract. If you don’t fully understand them, ask the loan officer to explain them to you before signing the loan contract. Legitimate money lenders would be more than happy to explain anything you might not understand before you sign the contract.

Know what happens when you default on your payments

Should you default on your loans, it is within the rights of legal money lenders to hire debt collection agencies to collect the debt back from you. These agencies need to follow a set of professional rules and a code of conduct as determined by the Ministry of Law.

The first thing they can do is send a Letter of Demand (LOD) to your residential address or workplace to demand that you return the money owed to them. They can also visit you at these places so that you are more pressured to repay what you owe.

In the event of disputes with licensed money lenders, the first step is to remain calm. Communicate with the other party respectfully to try and resolve the matter. Try and negotiate a deadline extension by communicating your predicament. If the situation escalates, get a third party such as a family member or friend to mediate or call the police.

Read the fine print before signing the loan contract

Do read the contract carefully and scrutinise every term and condition before putting pen to paper.

Imagine that you urgently need cash and decide to borrow from a seemingly reliable licensed money lender. After discussing the loan terms, they present you with a loan contract to sign. You’re in a hurry to get the money, so you sign the contract without reading the fine print.

A few weeks later, you realise that you’ve missed some important details in the contract. Perhaps the interest rate was much higher than what you were initially quoted, or there were additional fees that you weren’t aware of. As a result, you end up paying much more than you expected for the loan.

Had you taken the time to read and scrutinise every term and condition in the contract before signing, you would have been able to spot these discrepancies and negotiate better terms with the lender.

Stay clear of illegal money lenders in Singapore

You may come across illegal money lenders or loan sharks offering attractive loan terms and instant approval, but you should never engage with them in any capacity.

Engaging with illegal money lenders may result in you becoming a victim of money lender scams in Singapore or a money laundering activity. You may also find yourself suffering from unfairly high interest or be part of a loan contract that may land you in even greater debt. If you spot illegal money lenders touting their services, call the police immediately.

Here’s a comparison of legal and illegal money lenders to help you spot the bad apples out there:

| Legal money lenders | Illegal money lenders |

|---|---|

| Registered with the Ministry of Law | Not registered with the Ministry of Law |

| They advertise through business or consumer directories, their official website, or advertisements placed within or on the exterior of their registered place of business | They advertise through SMS, emails, calls, and WhatsApp |

| Conduct loan application and approval process with in-person verification | Conduct loan application and approval process entirely online without any face-to-face verification |

| Any fees are only paid when the loan is approved | May demand an upfront fee before loan approval |

| Approve loans only after thorough checking of factors that could affect the loan amount and repayment | Approve large loans without determining your ability to pay |

Consider borrowing from the bank first

When you need cash, it’s tempting to borrow from licensed, reliable money lenders in Singapore as you will get the cash fastest this way. However, do consider other options such as banks first.

This is because banks typically charge a relatively lower interest rate, which means that your cost of borrowing is lower. This, in turn, increases the chances of you fulfilling the loan repayment.

However, if you’re in urgent need of cash or have a bad credit score, licensed quick money lenders like Dio Credit can approve your loan application more leniently and disburse the funds you require much quicker than a bank usually can.

How to deal with licensed money lender harassment?

This means that they cannot do the following, which are common acts carried out by unlicensed money lenders:

- Send multiple SMSes or call repeatedly to harass borrowers

- Repeatedly contact or visit borrowers during odd hours. This can include the borrower’s home and workplace.

- Loiter around the borrower’s residential address and workplace to “ambush” the borrower

- Make threats, such as:

- “You’ll lose your job if you don’t pay up.” Do not heed such baseless threats.

- Threatening to announce your debt to all your family and friends

- Threatening to hurt you or your loved ones

- Threaten to resort to violence by assaulting you

Should you face such harassment, do the following:

- Call the police. It would be helpful to note down the time and location of such acts so that you can relay these details to them and make the investigation easier.

- Report the money lender to the Credit Association of Singapore (CAS).

- Report the money lender to the Ministry of Law.

Here are more tips to prevent money lenders’ harassment.

Your most reliable instant money lender – Dio Credit

As one of the highly reviewed reputable legal money lenders in Singapore, we offer a streamlined loan process and competitive rates to our customers. Rest assured that your experience with Dio Credit will be seamless and comfortable from start to end. From application to repayment, our experienced loan officers are here to guide you and ensure that your financial needs are met.